Featured News

Man Sentenced to Life in Lancaster for Killing Children and Grandmother

LANCASTER, Calif. – In a tragic and heart-wrenching case, a 32-year-old man from Lancaster was handed a life …

Recently Featured

More News

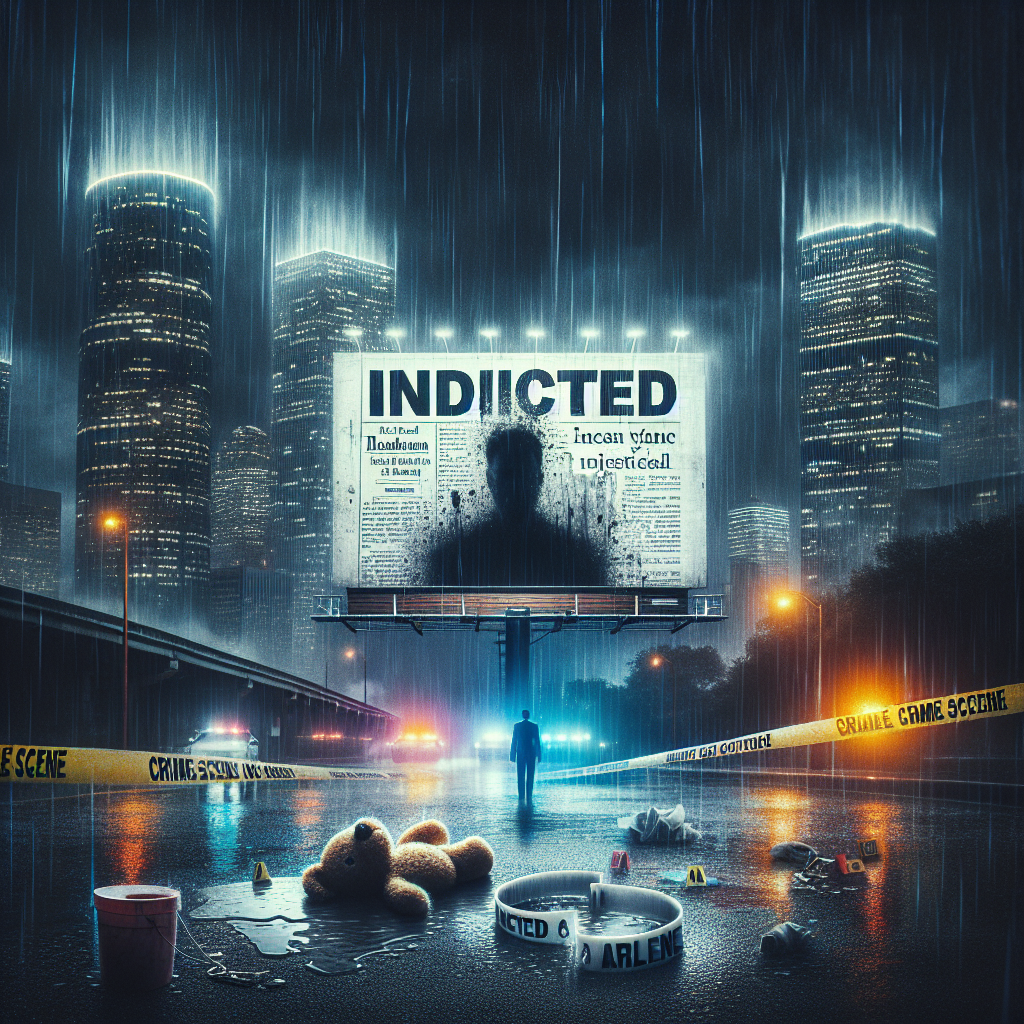

Man Indicted for Murder in Shooting of 9-Year-Old Girl in Harris County

HARRIS COUNTY, Texas – A man has been indicted for the murder of 9-year-old Arlene …

Indicted Houston Man Charged with Murder in Shooting of 9-Year-Old Arlene Alvarez

HOUSTON, TEXAS – A Houston man, Tony Earls Jr., 33, has been indicted by a …

Driver Arrested for Dangerous Driving Causing Death in Tampines Multiple-Vehicle Accident

Singapore – A tragic accident in Tampines on Monday morning resulted in the deaths of …

**Justice:** Man Sentenced to 8 Years for Vicious Assault on Ex-Girlfriend and New Partner at Remote Beach

Whangārei, New Zealand – A man was sentenced to eight years in prison for a …

Georgia Teen’s Bright Future Cut Short by Prom Weekend Shooting

COLUMBUS, Ga. – A father in Georgia is grieving the loss of his 16-year-old son, …

Shfaram Shooting Leaves Two Dead and One Severely Injured: Tragic Incident Unfolds

SHFARAM, ISRAEL – Two individuals were tragically killed, and another was left severely injured in …

Dolphin Found Dead on Louisiana Beach with Multiple Gunshot Wounds, NOAA Offering $20,000 Reward

TAMPA, Fla. – Authorities are offering a $20,000 reward for information after a dolphin was …

Teenage Girls Brutally Attack Peer Outside Henderson Bus Station In Shocking Video

Auckland, New Zealand – A disturbing video circulating on social media depicts a group of …

Shooting Tragedy Strikes Rosemead: Fatal Incident Resulting from Family Dispute

LOS ANGELES COUNTY, Calif. – A fatal shooting occurred in Rosemead, where a man lost …