Featured News

Homophobic Attacker with 39 Previous Convictions Jailed in Islington

London, United Kingdom – A man with 39 previous convictions has been sentenced to jail for a violent …

More News

Failures in System Led to Tragic Death of Daniel Weighman

London, England – Multiple failures were identified as contributing factors to the tragic death of …

Robbery Trial Unfolds: Witnesses Testify in Violent Halloween Home Invasion

Atlanta, Georgia – Witnesses testified Wednesday in court about a violent home invasion robbery that …

Subway Shooting Suspect Nearly Escapes Justice before Arrest

Philadelphia, Pennsylvania – A tragic shooting on a bustling SEPTA subway platform resulted in the …

Man Sentenced to Life in Lancaster for Killing Children and Grandmother

LANCASTER, Calif. – In a tragic and heart-wrenching case, a 32-year-old man from Lancaster was …

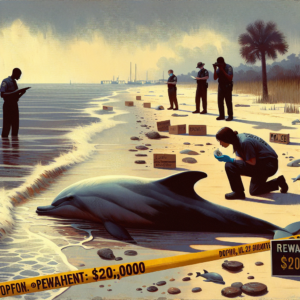

$20,000 Reward Offered for Tips on Louisiana Dolphin Shooting Investigation

Cameron Parish, Louisiana – A tragic discovery on West Mae’s Beach in Cameron Parish has …

Salman Rushdie and Christiane Amanpour Discuss Shocking 2022 Knife Attack

New York, USA – Acclaimed author Salman Rushdie recently sat down with renowned journalist Christiane …

Shooting in Dallas Near Fair Park Leaves Two Women Dead, Suspect Charged with Capital Murder

Dallas, Texas – Two lives were tragically lost in a shooting incident near Fair Park …

Carjacking Suspect Arrested in Connection to Florida Murder Mystery

Winter Springs, Florida – Authorities in Winter Springs, Florida, have made significant progress in the …

Dolphin Found Dead on Beach with Multiple Gunshot Wounds Spurs $20,000 Reward for Information

TAMPA, Fla. – The National Oceanic and Atmospheric Administration (NOAA) Fisheries Services is offering a …